About Medigap Benefits

Wiki Article

5 Easy Facts About Medigap Benefits Shown

Table of ContentsFacts About Medigap UncoveredSome Ideas on Medigap Benefits You Should KnowRumored Buzz on MedigapAll About MedigapAn Unbiased View of How Does Medigap Works

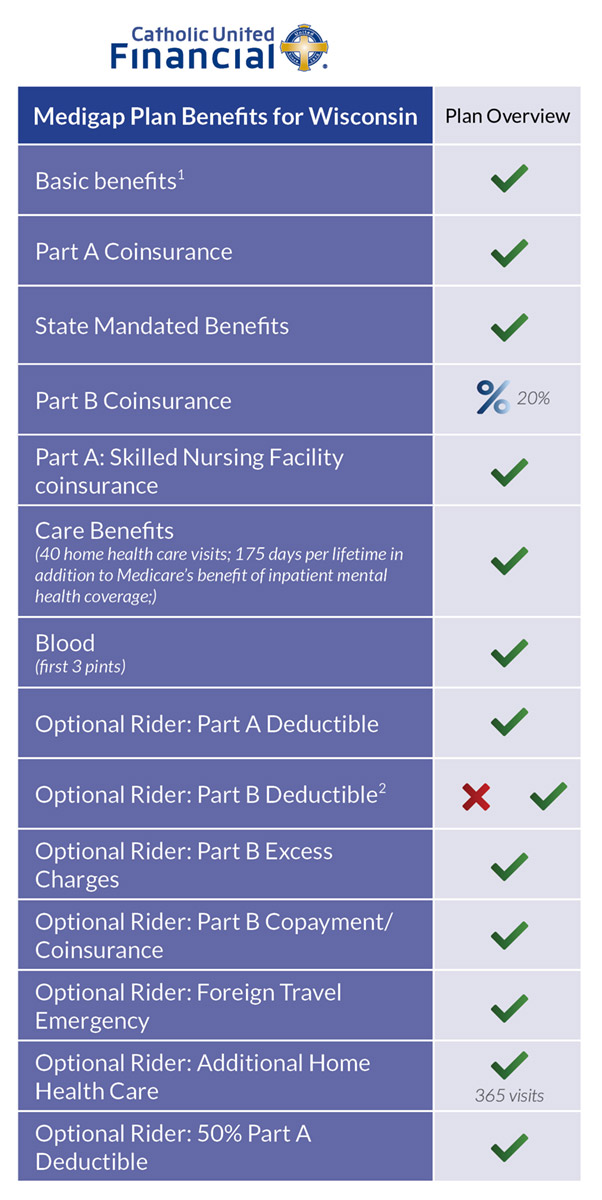

Medigap is Medicare Supplement Insurance coverage that aids fill "voids" in Original Medicare and also is sold by exclusive business. Original Medicare spends for much, yet not all, of the price for protected healthcare services and also materials. A Medicare Supplement Insurance Policy (Medigap) policy can aid pay several of the remaining wellness care costs, like: Copayments Coinsurance Deductibles Keep In Mind Note: Medigap prepares offered to individuals new to Medicare can no much longer cover the Part B insurance deductible.If you were eligible for Medicare prior to January 1, 2020, however not yet enlisted, you may be able to get one of these plans that cover the Component B insurance deductible (Plan C or F). If you currently have actually or were covered by Plan C or F (or the Strategy F high deductible version) prior to January 1, 2020, you can keep your plan.

After that, your Medigap insurer pays its share. 9 things to understand about Medigap policies You must have Medicare Component An as well as Part B. A Medigap policy is different from a Medicare Advantage Plan. Those strategies are ways to get Medicare benefits, while a Medigap plan only supplements your Initial Medicare benefits.

You pay this regular monthly premium in enhancement to the monthly Part B premium that you pay to Medicare. You can purchase a Medigap policy from any insurance coverage business that's accredited in your state to sell one.

Medigap Things To Know Before You Get This

A Medigap strategy (likewise called a Medicare Supplement), marketed by personal companies, can assist pay some of the wellness treatment prices Original Medicare does not cover, like copayments, coinsurance and deductibles. Some Medigap plans also offer insurance coverage for services that Original Medicare doesn't cover, like medical care when you take a trip outside the United state

Bear in mind that you can just have a Medigap if you have Original Medicare.

A Biased View of Medigap Benefits

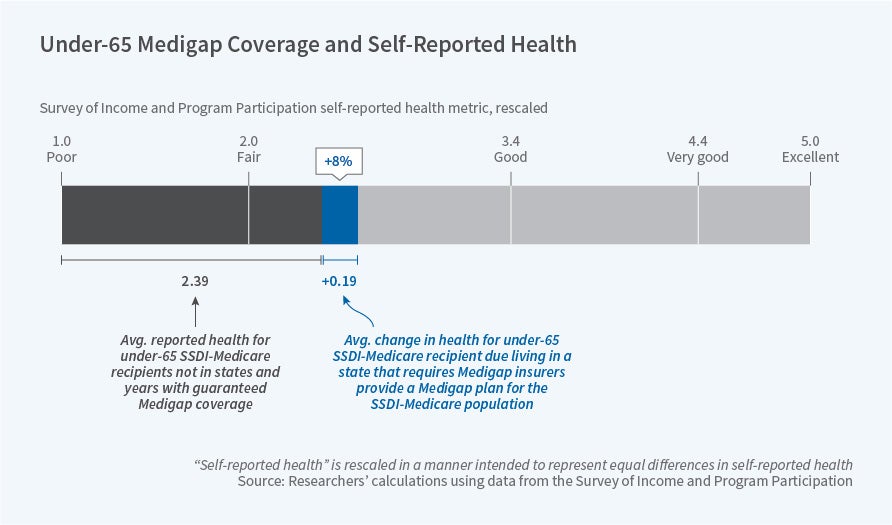

Medigap is extra insurance coverage that help cover the expenditures left to a medigap Medicare beneficiary What are Medigap strategies? Medigap vs. Medicare Benefit Expenses How to enlist Frequently asked questions If you have lately signed up in Medicare, you might have come across Medigap strategies and also questioned just how they work. Medigap policies, also referred to as Medicare Supplement plans, help cover some out-of-pocket expenses associated with Initial Medicare.

When you register, your Medicare Benefit Plan takes control of the management of your Medicare Component An and also Medicare Part B insurance coverage. Medigaps are meant merely to cover the Medicare expenses that Original Medicare leaves to the recipient. If you have a Medigap plan, Medicare pays its share of the Medicare-approved amount for protected services and afterwards your Medigap policy will certainly pay its share of covered advantages.

In 2022 with Plan F, you can anticipate to pay between $160 as well as $300. Plan G would usually vary between $90 as well as $150, and also Strategy N would certainly be about $78 to $140. What is Medigap.

The Greatest Guide To Medigap

Enlisting in a Medicare Supplement insurance plan will certainly help in covering expenditures. Action 1: Decide which advantages you want, after that choose which of the Medigap strategy types (letter) fulfills your needs. Action 2: Find out which insurer market Medigap policies in your state. Step 3: Discover about the insurance coverage firms that offer the Medigap plans you're interested in as well as compare prices.The very best time to get a Medicare Supplement strategy is during your six-month Medigap Open Enrollment Period. The Open Registration Duration starts the initial month you have Component B coverage and you're 65 or older. Since Medigap strategies are offered by private insurer, they are generally enabled to utilize clinical underwriting to make a decision whether to accept your application and what your cost will be.

The list below aspects can impact the cost of Medicare Supplement intends: Your location Your sex Your age Cigarette use Home price cuts Exactly how you pay When you enroll Medigap costs need to be approved by the state's insurance policy department and are set based on plan history and operating expenses. There are three rankings utilized that can impact your rates and also price boosts.

Problem Age doesn't mean the strategy will not see a price increase. You will usually pay even more when you're younger yet less as you age.

All about Medigap

Neighborhood Rated: Area rating means everyone in the area pays the exact same price. A lot of states as well as providers use the attained age ranking when pricing their Medicare Supplement insurance coverage.Report this wiki page